Introduction

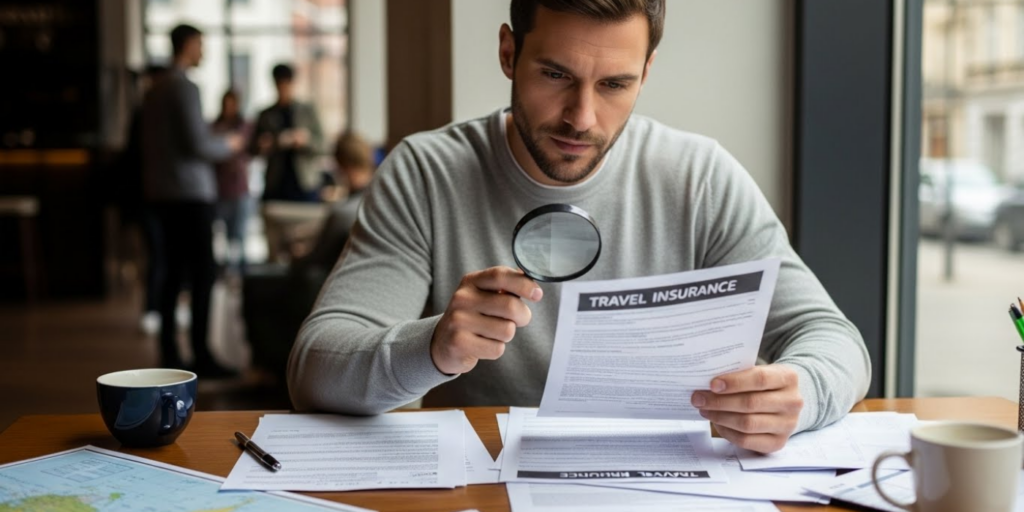

Imagine this: you’ve saved for months for your dream trip to Italy. Flights are booked, hotels reserved, and your suitcase is packed. Then, two days before departure, you come down with a severe flu—or worse, a family emergency forces you to cancel. Suddenly, thousands of dollars vanish with no refund. Heartbreaking? Absolutely. But completely preventable—with the right travel insurance.

Travel insurance isn’t just for globe-trotting adventurers or luxury cruisers. It’s a smart, affordable safety net for anyone who books non-refundable travel. Yet, many travelers either skip it entirely or buy the first policy they see—only to discover too late that it doesn’t cover their specific needs.

In this guide, we’ll walk you through everything you need to know to choose the perfect travel insurance for your trip. You’ll learn what types of coverage matter most, how to compare policies like a pro, common pitfalls to avoid, and real-life scenarios where insurance made all the difference. Whether you’re planning a weekend getaway or a year-long backpacking journey, this guide will help you travel with confidence—knowing you’re protected no matter what unfolds. Let’s turn uncertainty into peace of mind.

Understand the Types of Coverage You Actually Need

Not all travel insurance is created equal—and you don’t need every type of coverage for every trip. The key is to match your policy to your itinerary, health, and risk tolerance.

Here are the most common coverage types—and why they matter:

- Trip Cancellation/Interruption: Reimburses prepaid, non-refundable costs if you cancel or cut your trip short due to covered reasons (like illness, injury, or death in the family). This is the #1 reason people file claims.

- Emergency Medical & Evacuation: Covers hospital visits, doctor fees, and even air ambulance transport if you’re seriously injured or ill abroad. Crucial if your regular health insurance doesn’t cover international care—which most U.S. plans don’t.

- Baggage Loss/Delay: Reimburses essentials (like toiletries or clothes) if your luggage is delayed 12+ hours, or replaces items if it’s lost permanently.

- Travel Delay: Covers meals and lodging if you’re stranded due to weather, mechanical issues, or strikes.

- Cancel for Any Reason (CFAR): A premium upgrade that lets you cancel for any reason (e.g., fear of flying, job loss) and recover 50–75% of your trip cost. Must be purchased within 10–21 days of your initial deposit.

Example: Sarah booked a $3,000 honeymoon to Greece. Two weeks before departure, wildfires broke out near her resort. Her standard policy didn’t cover “fear of travel”—but if she’d bought CFAR, she could’ve canceled and recovered $2,250.

Ask yourself: What would hurt most—losing money on flights? Being stuck with a $10,000 hospital bill overseas? Missing your cruise due to a delayed connection? Your answer determines your priorities.

Compare Policies—Don’t Just Buy the Cheapest Option

It’s tempting to go with the lowest price, but travel insurance is not one-size-fits-all. A $30 policy might exclude pre-existing conditions, adventure activities, or even “acts of nature”—leaving you exposed when you need help most.

Instead, use a comparison tool like Squaremouth, InsureMyTrip, or TravelInsurance.com. These sites let you:

- Filter by coverage type (e.g., “must include medical”)

- Compare deductibles and coverage limits

- Read policy wording (not just marketing blurbs)

- Check customer reviews and claim payout rates

Pay attention to fine print:

- Pre-existing condition waiver: Most policies exclude them—unless you buy within 10–21 days of your first trip payment and insure 100% of pre-paid costs.

- Adventure sports: Standard policies often exclude scuba diving, skiing, or zip-lining. Look for “adventure coverage” add-ons.

- Country exclusions: Some insurers won’t cover trips to countries under U.S. State Department “Do Not Travel” advisories.

Real talk: A slightly more expensive policy with clear, comprehensive coverage is always better than a cheap one full of loopholes. Think of it like car insurance—you want it to work when you need it.

Timing Matters: When to Buy (and When It’s Too Late)

When you buy travel insurance is almost as important as what you buy.

Best practice: Purchase within 10–21 days of making your first trip payment. Why?

- You qualify for pre-existing condition waivers

- You’re covered if the airline or cruise line goes bankrupt

- You can add CFAR (if available)

Last-minute buyers: You can still buy medical-only or basic trip insurance up to the day before departure—but you’ll miss key benefits like pre-existing condition coverage.

Never wait until you’re already traveling. Once your trip starts, cancellation coverage is off the table. (Though some insurers offer “post-departure” medical plans.)

Pro tip: If your trip involves multiple payments (e.g., flight now, hotel in 60 days), insure the total expected cost at the time of purchase. You can often update your policy later as you pay more.

Know What’s NOT Covered (So You’re Not Surprised)

Even the best policy has exclusions. Common ones include:

- Pandemics/Epidemics: Many policies now exclude known outbreaks (e.g., if a destination has an active CDC warning).

- Reckless behavior: Injuries from drinking, drug use, or ignoring local laws.

- High-risk destinations: Travel to war zones or areas with active civil unrest.

- Routine medical care: Checkups, prescriptions for chronic conditions, or elective procedures.

Important: “Fear of travel” is not a covered reason to cancel—unless you have CFAR. So if you’re nervous about political instability or weather, CFAR might be worth the extra cost.

Always read the “Exclusions” section of your policy. It’s boring, but it could save you from a nasty surprise.

Special Considerations: Cruises, International Travel, and Frequent Flyers

Your travel style changes your insurance needs.

Cruises:

- Cancellation penalties are steep (often 100% within 30 days).

- Medical care on ships is expensive and limited—evacuation coverage is essential.

- Look for policies that cover “missed port” or “cruise line bankruptcy.”

International Travel:

- Your U.S. health insurance likely offers zero coverage abroad. Emergency medical should be your #1 priority.

- Some countries (like Schengen Zone nations) require proof of medical insurance to enter.

Frequent Travelers:

- If you take 3+ trips a year, consider an annual multi-trip policy. It’s often cheaper than insuring each trip separately and covers all trips under a set duration (e.g., 30–45 days per trip).

Older Travelers:

- Premiums rise with age, but specialized insurers (like Medjet or Berkshire Hathaway) offer strong medical and evacuation plans for seniors.

How to File a Claim—And Why Documentation Is Key

Buying insurance is step one—getting paid is step two. And that depends on documentation.

If something goes wrong:

- Contact your insurer immediately—most require claims within 20–90 days.

- Save everything: Boarding passes, hotel receipts, doctor’s notes, police reports (for theft), airline delay notices.

- Fill out forms accurately and submit via the insurer’s portal or email.

Common claim mistakes:

- Missing deadlines

- Not proving non-refundability (e.g., showing you couldn’t get a flight credit)

- Assuming “canceled flight = automatic payout” (you must show you couldn’t rebook reasonably)

Good news: Reputable insurers process 80–90% of claims within 10–14 days. Keep digital copies of all documents in your email or cloud storage—just in case your luggage vanishes.

Conclusion

Travel insurance isn’t about expecting the worst—it’s about preparing for the unexpected so you can embrace the best parts of your journey without fear. By understanding your coverage needs, comparing policies wisely, buying at the right time, and knowing what’s excluded, you transform a confusing purchase into a powerful tool for confident travel.

Remember: the goal isn’t to avoid all risk—it’s to ensure that if life throws a curveball, your dream trip doesn’t become a financial nightmare. A little planning today can save heartache (and thousands of dollars) tomorrow.

So before you hit “book” on that next adventure, take 15 minutes to explore your options. Your future self—relaxing on a beach or exploring a mountain trail—will thank you.

Have you ever used travel insurance? Did it save your trip—or were you caught off guard? Share your experience in the comments! And if this guide helped you feel more informed, pass it along to a friend who’s planning their next getaway. Safe travels—and even safer planning!

James Anderson is a passionate enthusiast of travel, fine dining, financial freedom, and personal performance. Always seeking new experiences and challenges, he believes in living life fully while continuously improving himself. For James, exploring new destinations, savoring unique culinary experiences, and striving for independence are not just hobbies—they are a lifestyle built on curiosity, growth, and the pursuit of excellence.